child tax credit monthly payments continue in 2022

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Those returns would have information like income filing status and how many children are.

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

For 2022 there would be 12 monthly payments under the Build Back Better plan but the.

. Get the most out of your income tax refund. The advance child tax credit payments were based on 2019 or 2020 tax returns on file. For the 2022 tax year the credit goes back to 2000 per eligible child.

Ad Get Help maximize your income tax credit so you keep more of your hard earned money. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments.

Will the monthly child tax credit continue in 2022. It is possible for the Child Tax Credit advance. 2022 Child Tax Credit.

You will no longer receive monthly payments. Ad Home of the Free Federal Tax Return. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Child Tax Credit Payment Schedule 2022 from pincaliforniacompanyinfo The payments will be paid via direct deposit. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Ad Review the Guidelines and Steps to Apply for the Child Tax Relief Program With Our Guide. How will child tax credit payments work in 2022.

Check How to Qualify for the Child Tax Relief Program with Our Guide. Parents E-File to Get the Credits Deductions You Deserve. E-File Directly to the IRS.

Learn More at AARP. 6 Often Overlooked Tax Breaks You Dont Want to Miss.

Monthly Child Tax Credit Payments Begin Today Here S How Much You Can Expect Nextadvisor With Time

Future Child Tax Credit Payments Could Come With Work Requirements

Stimulus Update Will Child Tax Credit Monthly Payments Restart Al Com

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

New Child Tax Credit Explained When Will Monthly Payments Start 9news Com

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Will Monthly Child Tax Credit Payments Be Extended Into 2022 Fast Forward Accounting Solutions

Will Monthly Child Tax Credit Payments Continue Into 2022 Whas11 Com

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

2022 Child Tax Credit Legal Guide Rocket Lawyer

Child Tax Credit Will Monthly Payments Continue Into 2022 Gobankingrates

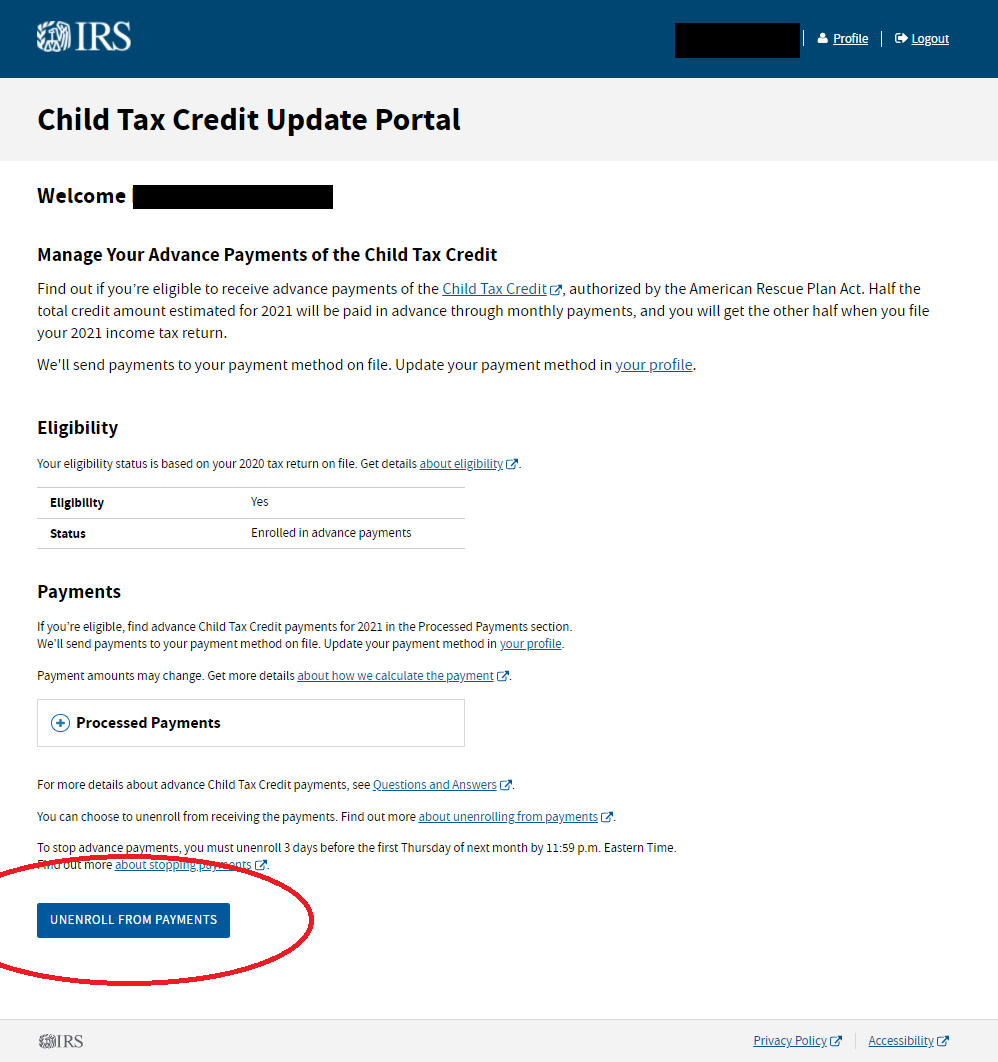

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

About The 2021 Expanded Child Tax Credit Payment Program

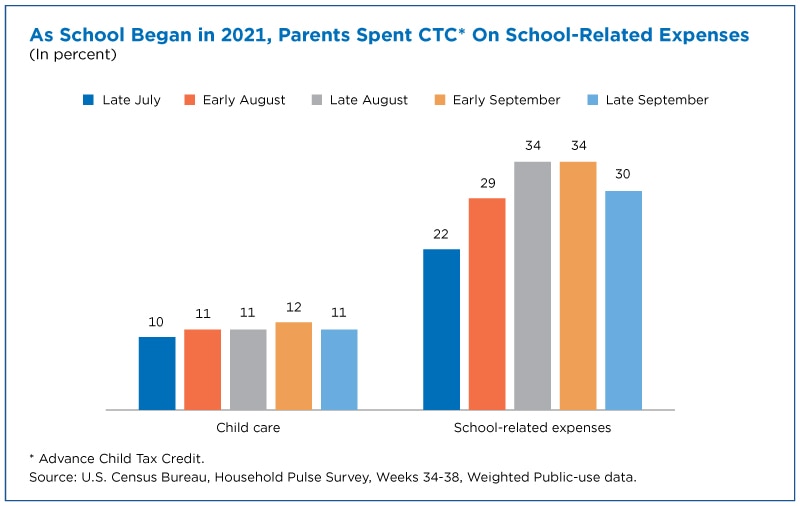

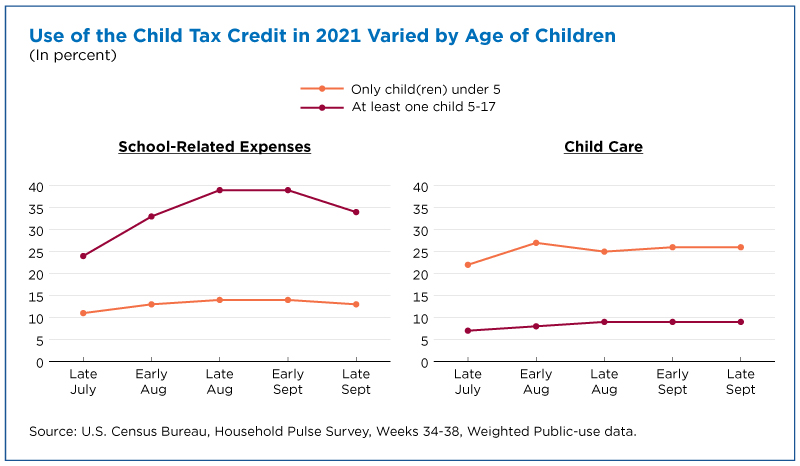

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

Where Things Stand With The Monthly Child Tax Credit Payments Npr

Widely Supported Child Tax Credit Is Associated With Better Perceptions Of The Economy And Greater Trust Of Democrats